Kweichow Moutai starts to diversify investments, venturing into semiconductor chips

Chinese liquor giant Kweichow Moutai has recently ventured into the chip sector. Industry experts said this move will allow the traditional liquor producer to capitalize on the booming chip industry, while providing much-needed capital for innovation in the increasingly important technology sector.

According to corporate information website Tianyancha, two fund companies of Moutai including Moutai Science and Technology Innovation Investment Fund have recently invested in Shanghai SmartLogic. The latter specializes in domestic chip-making technology.

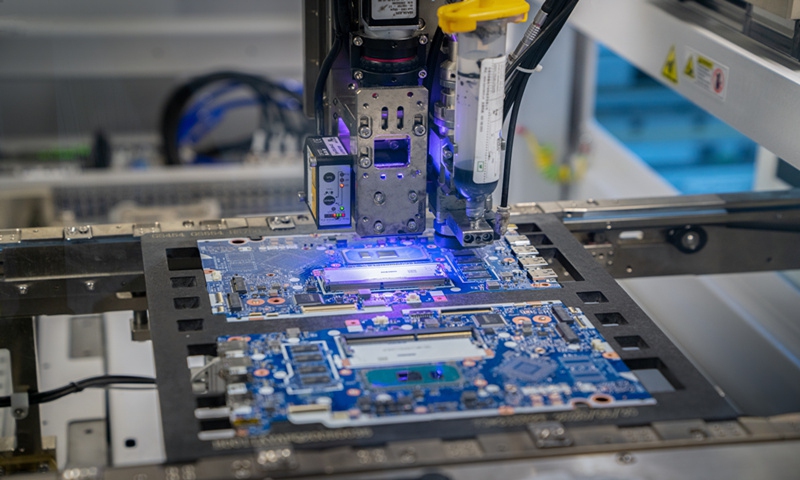

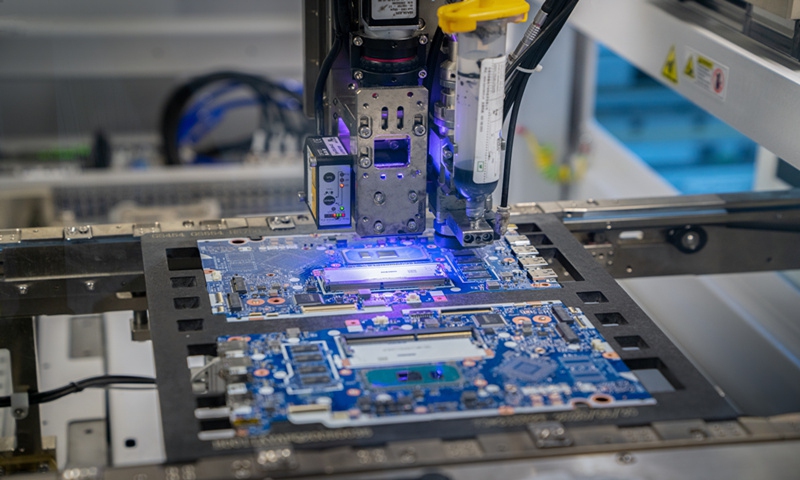

Public information reveals that SmartLogic is a high-tech enterprise dedicated to the research and development of domestically produced autonomous processor cores, chip design, and applications. Leveraging its independently developed MaPU architecture for algebraic computation processors, SmartLogic fills a gap in the field of domestic chip architecture, according to media reports.

One of the investing parties, Moutai Science and Technology Innovation Investment Fund, was set up in Beijing last September, with a registered capital of 200 million yuan. SmartLogic marks the first chip enterprise invested by the fund.

Moutai Group previously stated that the establishment of this fund aims to enhance the innovation capabilities of its subsidiaries, leverage state-owned capital's leading role and leverage effect, and provide more robust financial support for the marketization and industrialization of technological achievements, the National Business Daily reported.

In the current AI-driven boom, investments into chip related sectors are flourishing. Moutai's move into this sector exemplifies seizing the investment opportunity in the chip industry, Ma Jihua, a senior industry analyst, told the Global Times on Wednesday.

Ma said that Moutai needs to seek new growth engines beyond its well-developed traditional liquor-making business, which offers limited room for further growth. Meanwhile, the domestic chip industry is booming and requires substantial investment in innovation, making the involvement of well-capitalized companies like Moutai crucial for its development, Ma said.

In recent years, Moutai has accelerated its pace of cross-border investments.

In 2023, it allocated billions to establish two industrial development funds, expanding its investment scope from consumption to new-generation information technology, biotechnology, new energy, new materials, and high-end equipment, among other fields.

In the broader context, in recent years, China's chip industry has been developing rapidly, with the semiconductor and component industries experiencing a long-expected resurgence in 2024.

According to data from the National Bureau of Statistics, domestic integrated circuit production reached 135.39 billion units in the first four months this year, a year-on-year growth of 37.2 percent, setting a new record.

Moutai is not alone. Recently, Tianyancha showed that funds under Luzhou Laojiao, a Sichuan-based liquor maker, invested in Global Power Technology Co, according to media reports.