GT Voice: Failures in US solar sector call for reflection on protectionism

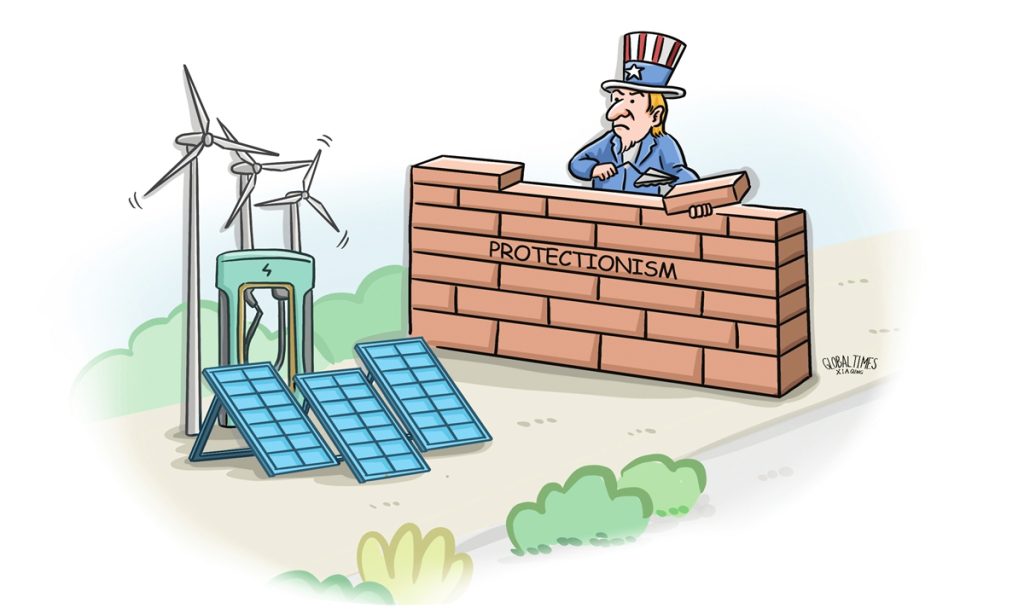

The recent wave of failures in the US solar industry serves as yet another example of how protectionism impedes the sustainable development of a promising industry.

Shares of SunPower Corp, one of the largest solar installers in the US, tumbled 73 percent last week as the company said that it will no longer support new leases, installations or product shipments, with analysts largely writing the company off as on the verge of going out of business, according to media reports.

The shares slumped 54 percent on Friday afternoon in New York, making it the second-worst performer in the Nasdaq Composite.

The collapse of SunPower reflects its own operational problems, and it represents the latest blow to a troubled industry that is experiencing a wave of bankruptcies. It's also a cautionary tale for the US to reflect on its protectionist industrial policies.

About a week ago, Ohio-based Toledo Solar said that it would end all research and development efforts and wind down operations, effective immediately. In June, Titan Solar shut its doors and filed for bankruptcy.

In late 2023 alone, more than 100 residential solar dealers and installers in the US declared bankruptcy, six times the number in the previous three years combined, according to Roth Capital Partners. Roth also expects at least 100 more to fail.

Multiple factors likely contributed to the downfall of those solar companies in the US. For instance, the US Federal Reserve has kept interest rates high, leading to increasing borrowing costs and reducing the appeal of solar energy as a cost-saving investment, further causing a decline in consumer demand for solar energy. Costs have increased instead of decreasing, emerging as the primary hindrance to the growth of the solar market in the US.

According to data platform Ohm Analytics, residential solar installations in the US are anticipated to decrease by 20 percent year-on-year in 2024 as the market adapts to the changing rate environment and incorporates batteries into customer offerings. Also, industry groups predict that installations in California, the largest rooftop-solar market in the US, will plummet by more than 40 percent this year and continue to decline until 2028.

These developments also demonstrate that the strategy of increasing tariff barriers in the US to suppress the Chinese solar industry and promote the growth of the domestic solar industry has not yielded the anticipated positive outcomes. This approach overlooks the vital role of market competition in stimulating industry innovation and technological advancement.

The imposition of trade barriers hurts Chinese solar companies while failing to bolster the competitiveness of the US solar industry. This results in companies overly relying on policy support and neglecting the significance of cost reduction through technological innovation and enhanced production efficiency.

While trade barriers and policy support may benefit individual solar companies like First Solar, which has emerged as the world's most valuable solar manufacturer in the capital market, the industry as a whole lacks the drive to cut costs and improve efficiency.

The challenges faced by the solar industry due to US trade barriers underscore the broader issue of protectionism. This trend is not exclusive to solar, as other industries like the electric vehicle sector also grapple with similar obstacles.

While trade barriers may offer temporary protection for local companies, they could ultimately hinder industry growth.

This situation further highlights the necessity of coordinated industrial policy between China and the US. The unilateral US implementation of trade barriers to hinder China's progress in various sectors contradicts the spirit of mutually beneficial cooperation and could lead to a lose-lose scenario.

While competition in manufacturing does exist between the two countries, excessive confrontational tactics like trade barriers damage both parties' interests and could worsen the industry's challenges. Only a policy founded on fair competition can foster the long-term growth of an industry.